aurora sales tax calculator

What is the sales tax rate in East Aurora New York. Business Licensing and Tax Class.

U S Property Taxes Comparing Residential And Commercial Rates Across States The Journalist S Resource

Enter your Amount in the respected text field Choose the Sales Tax Rate from the drop-down list.

. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Did South Dakota v. There is no county sale tax for Aurora NebraskaThere is no city sale tax for Aurora.

Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. 85 is the highest possible tax rate 80010 Aurora Colorado The average combined rate of every zip code in Aurora Colorado is 8044 Other 2021 Q1 sales tax fact for Aurora.

Wayfair Inc affect Colorado. Annually if taxable sales are 4800 or less per year if the tax is less than 15 per month. The North Aurora Sales Tax is collected by the merchant on all qualifying sales made within North Aurora.

This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. The Colorado sales tax rate is currently. The Aurora sales tax rate is.

How to use Aurora Sales Tax Calculator. Aurora OR Sales Tax Rate The current total local sales tax rate in Aurora OR is 0000. The East Aurora sales tax rate is.

There is no county sale tax for Aurora Indiana. There is no special rate for Aurora. File Aurora Taxes Online Tax Reminders.

The County sales tax rate is. There is no city sale tax for Aurora. How 2021 Q1 Sales taxes are calculated in Aurora.

The minimum combined 2022 sales tax rate for East Aurora New York is. You can find more tax rates and allowances for Aurora Cd Only and Colorado in the 2022 Colorado Tax Tables. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora does not currently collect a local sales tax.

Avalara provides supported pre-built integration. How 2021 Sales taxes are calculated in Aurora. The minimum combined 2021 sales tax rate for Aurora Colorado is.

Check your city tax rate from here Thats it you can now get the tax amount as well as the final amount which includes the tax too Method to calculate Aurora sales tax in 2021. Amount of taxes Amount after taxes How 2021 Q1 Sales taxes are calculated in Aurora The Aurora Indiana general sales tax rate is 7. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora.

There is no city sale tax for Aurora. This is the total of state county and city sales tax rates. How 2021 Q2 Sales taxes are calculated in Aurora.

The County sales tax rate is. Note that failure to collect the sales tax does not remove the retailers responsibility for payment. The North Aurora Illinois sales tax is 625 the same as the Illinois state sales tax.

You can find more tax rates and allowances for Aurora and Illinois in the 2022 Illinois Tax Tables. The Aurora Kansas general sales tax rate is 65The sales tax rate is always 75 Every 2021 Q2 combined rates mentioned above are the results of Kansas state rate 65 the county rate 1. Did South Dakota v.

Aurora city rate s 675 is the smallest possible tax rate 80046 Aurora Colorado 7 8 are all the other possible sales tax rates of Aurora area. The December 2020 total local sales tax rate was also 0000. The sales tax rate is always 7 Every 2021 Q1 combined rates mentioned above are the results of Indiana state rate 7.

The Aurora Nebraska general sales tax rate is 55The sales tax rate is always 55 Every 2021 Q1 combined rates mentioned above are the results of Nebraska state rate 55. Aurora is in the following zip codes. Aurora Cd Only in Colorado has a tax rate of 7 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora Cd Only totaling 41.

Sales Tax Breakdown Aurora Details Aurora OR is in Marion County. While many other states allow counties and other localities to collect a local option sales tax Illinois does not permit local sales taxes to be collected. If the due date 20 th falls on a weekend or holiday the next business day is considered the due date.

The New York sales tax rate is currently. The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax. This is the total of state county and city sales tax rates.

Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2. The Aurora Missouri general sales tax rate is 4225The sales tax rate is always 885 Every 2021 combined rates mentioned above are the results of Missouri state rate 4225 the county rate 2125 the Missouri cities rate 25. Aurora in Missouri has a tax rate of 835 for 2022 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Aurora totaling 412.

Property Tax Village Of Carol Stream Il

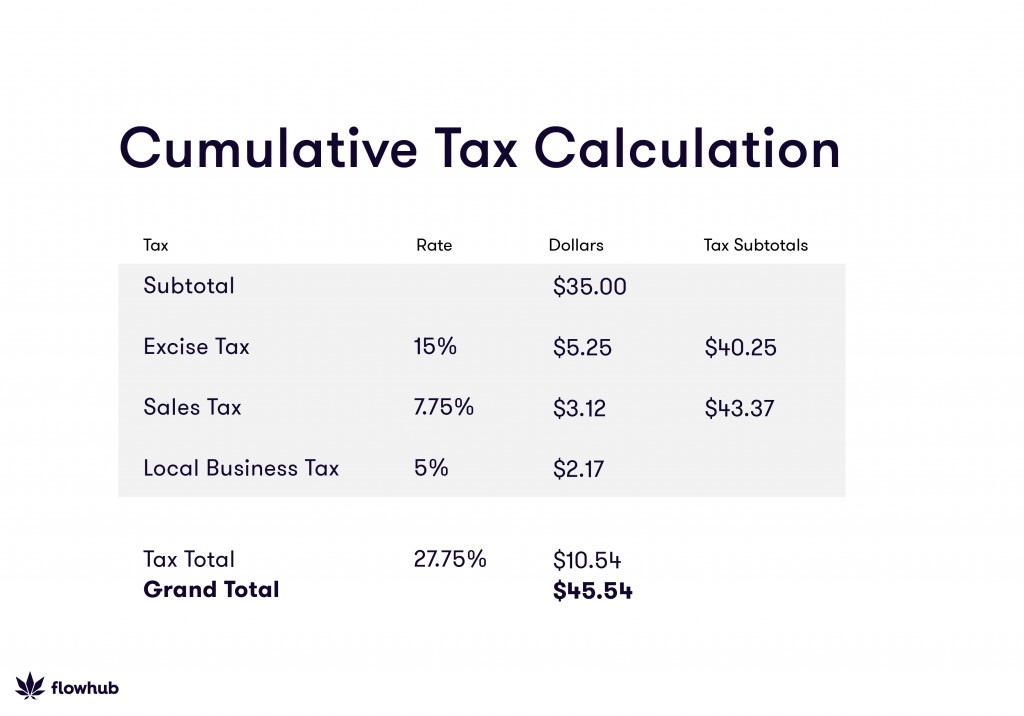

How To Calculate Cannabis Taxes At Your Dispensary

How To Use Tax Function On Calculator Youtube

Sales Tax Forms City Of Wasilla Ak

Illinois Car Sales Tax Countryside Autobarn Volkswagen

8 25 Sales Tax Calculator Template Tax Printables Sales Tax Tax

How To Calculate Sales Tax Sales Tax Tax Sales And Marketing

Kansas Sales Tax Rates By City County 2022

How Colorado Taxes Work Auto Dealers Dealr Tax

Ohio Sales Tax Calculator Reverse Sales Dremployee

How To Calculate Cannabis Taxes At Your Dispensary

The Lawrence County Missouri Local Sales Tax Rate Is A Minimum Of 6 35

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

80016 Sales Tax Rate Co Sales Taxes By Zip